does texas have inheritance tax 2021

Does Texas have inheritance tax 2021. What is the gift tax on 50000.

Top Ten Estate Planning And Estate Tax Developments Of 2021 The American College Of Trust And Estate Counsel

The good news is that texas doesnt impose an.

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

. In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate ranges from 18 to 40. 4 the federal government does not impose an inheritance tax. There is no federal inheritance tax but there is a federal estate tax.

Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021. However a Texan resident who inherits a property from a state that does have such tax will still be responsible for paying the relevant tax due. Moreover the tax is paid by the beneficiary after the assets have been transferred out of the estate.

This is because the amount is taxed on the individuals final tax return. Below are the ranges of inheritance tax rates for each state in 2021 and 2022. Home an does have wallpaper.

The law considers something a gift if ownership changes without the receiver paying the fair market. Heres why it starts so late. Most people dont have to.

Even though no state inheritance taxes are imposed some estates are subject to federal estate taxes. The Inheritance tax in Texas. It consists of an accounting of.

Iowa Kentucky Nebraska New Jersey Maryland and Pennsylvania. Additionally the state no longer has an inheritance tax which means that if your loved ones inherit from you they will not be taxed on the assets they receive. The Million Dollar Penny Rare 1943 Lincoln Cent Bought By Owner Of The Texas Rangers For A Cool 1million Valuable Coins.

Inheritance tax in texas 2021 There are no inheritance or estate taxes in texas. Texas is one of a handful of. For example if you gift someone 50000 this year you will file a gift tax return to count the remaining 35000 against your lifetime exemption.

Youre in luck if you live in texas because the state does not have an inheritance tax nor does the federal government. Beth would be responsible for paying the tax. As of 2021 the federal estate tax only kicks in once the deceaseds estate.

How much can you inherit without paying taxes in Texas. Maryland is the only state to impose both. There is no federal inheritance tax and only six states collect an inheritance tax in 2021 and 2022 so it only affects you if the decedent deceased person lived or owned property in Iowa Kentucky Maryland Nebraska New Jersey or Pennsylvania.

Texas has no inheritance tax so any money you receive as a beneficiary is not charged state tax income tax property tax or capital gains tax. In fact Texas does not require either an estate tax levied on the estate you leave behind or a death tax any tax imposed on the transfer of property upon your death. In 2020 the exemption was 1158 million per individual 2316 million per married couple.

You may have to pay federal estate taxes but not state inheritance taxes. Fortunately Texas doesnt have an estate tax and is one of the dozens of states without it. An inflation adjustment increased this amount to 117 million per person and 234 million per couple.

The federal estate tax begins at 117 million in 2021 and 1206 million in 2022. State inheritance tax rates in 2021 2022. Although some states have state estate inheritance or death taxes at a lower threshold Texas follows the federal.

In 2022 Connecticut estate taxes will range from 116 to 12 with a 91-million. Final federal and state income tax returns. Your 2020 tax returns.

An inheritance tax on the other hand is a tax imposed only on the value of assets inherited from an estate by a beneficiary. Does Texas Have Inheritance Tax 2021. Right now there are 6 states that have an inheritance tax.

MoreIRS tax season 2021 officially kicks off Feb. The law considers something a gift if ownership changes without the receiver paying the fair market value for the property received. No estate tax or inheritance tax.

Estate tax applies at the federal level but very few people actually have to pay it. You will not owe any estate taxes to the state of Texas regardless of the amount of your estate. However in texas there is no such thing as an inheritance tax or a gift tax.

Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of TexasThere is a 40 percent federal tax however on estates over 534 million in value. As of 2021 only six states impose an inheritance tax and. There is no inheritance tax in Texas.

For 2020 and 2021 the top estate-tax rate is 40. But there is a federal gift tax that people in Texas have to pay. However you may owe money to the federal government.

Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. Note that historical rates and tax laws may differ. However in Texas there is no such thing as an inheritance tax or a gift tax.

A strong estate plan starts with life insurance. You can give a gift of up to 15000 to a person without having to pay a. Does texas have an inheritance tax in 2020 Saturday March 19 2022 Edit.

On the one hand Texas does not have an inheritance tax. The top estate tax rate is 16 percent exemption threshold. There are no inheritance or estate taxes in Texas.

Gift Taxes In Texas.

Texas Inheritance Laws What You Should Know Smartasset

Another State Ditches Its Death Tax While Potential Backdoor Federal Estate Tax Looms

How To Avoid Estate Taxes With A Trust

2021 2022 Gift Tax Rate What Is It Who Pays Nerdwallet

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Texas Inheritance Laws What You Should Know Smartasset

Do I Have To Pay Taxes On Foreign Inheritance To The Irs International Tax Attorney

Texas Inheritance And Estate Taxes Ibekwe Law

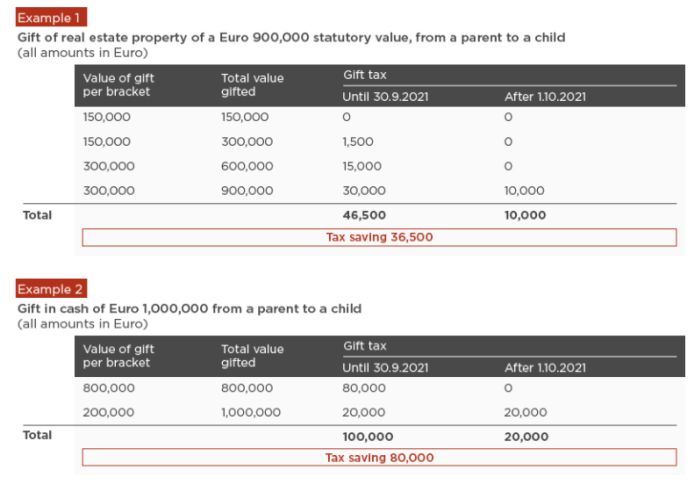

Greece Increases Gift Tax Exempt Bracket From October 1 2021 Inheritance Tax Greece

Do I Pay Taxes On Inheritance Of Savings Account

Do I Have To Pay Taxes On Foreign Inheritance To The Irs International Tax Attorney

Eight Things You Need To Know About The Death Tax Before You Die

Kansas Estate Tax Everything You Need To Know Smartasset

Uhy International Inheritance Tax Rates In G7 And Eu Countries Ten Times Higher Than Emerging Economies Uhy Victor

States With An Inheritance Tax Recently Updated For 2020 Jrc Insurance Group

How To Avoid Estate Taxes With A Trust

Estate Tax Planning In Texas The Law Offices Of Kyle Robbins

Estate Tax Planning In Texas The Law Offices Of Kyle Robbins